Hello, I am losing an ongoing email argument with the Vermont state tax department and they have not given me the MATH FORMULA they use to determine a persons property tax adjustment.

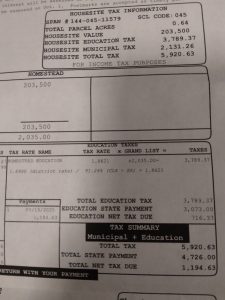

My total income in 2024 was $12,224. and my house is assessed at $203,500.

The state education portion of my 2025 property tax bill was $3,789.

and the municipal tax portion was $2,131.

I received a property tax adjustment of $4,726.

My net due was $1,194.

which I paid,

but am now arguing about it because

that amount is 9.7% of my annual income.

My monthly income in 2024 was $1018.

so the $1,194. bill is more than

I received for my income each month in 2024.

$1,194 is about 9.7% of my total annual senior citizen social security

income in 2024 and I did not have, and do not have, any other income.

Do you think that a Vermont senior citizen, age 73 on a fixed income of

social security with no other income, and a house assessed at $203,500.

(because over the years it just keeps getting assessed higher),

do you think that an old arthritic body like me should be paying

9.7% of my total annual income in property tax, after adjustment?

crisericson9@gmail.com

And don’t call me if you are a real estate agent, I will eat dandelion

greens! I have a pile of rice and beans, I will survive.

The out-of-state real estate agents are salivating by now.

The Lobbyists for real estate agents may have gotten to the Vermont state legislators and they might have given them huge campaign contributions for the last election and the next one.

If you want to help me start a new minor political party, now is the time!

crisericson9@gmail.com put “new party” in the subject heading.

I refuse to move to Florida, I have met many senior citizens who wish they never did! Too many insects! Huge electric bills for air conditioning! Non-potable water coming out of your sink faucet!

I refuse to take in renters because I can’t afford the increased risks of slip and fall accidents, raised home owners insurance, plumbing disasters, etc. You have to own a lot of rental units to make any money and you spend all your time in court with Tennant disputes.

I have arthritis and the primary care at Dartmouth refuses to give me a prescription painkiller because they would have to comply with reporting requirements, so I can’t go work at Walmart.

I’m in the benefits trap, even if I figured out how to work a few hours a week online, I would lose more in benefits, its too narrow an acrobatic rope to cross.

So, again, I ask, because I have NOT received an answer from the secretive Vermont Department of Taxes who commit financial harm to senior citizens on a fixed tiny social security income with their non-transparent formula:

WHAT IS THE FORMULA THE VERMONT DEPARTMENT OF TAXES USES TO FIGURE YOUR PROPERTY TAX ADJUSTMENT AMOUNT THEY CONTRIBUTE TO YOUR TOTAL BILL?

and again, if you think senior citizens on a fixed income in Vermont should

NOT be paying 9.7% of their total annual income in property tax, after adjustment,

then PLEASE help me start a new minor political party immediately!

crisericson9@gmail.com

State has the info

I’d trust what the VT Tax Office says on this matter.

The property tax credit is based on income – in 2024 the max income was $115k, so if you were under that and met the eligibility checklist, you get the rebate. There are exceptions.

The maximum credit is $5,600 for the State education property tax portion and $2,400 for the municipal property tax portion.

How to figure out what that exact credit is is outlined in state statute:

https://legislature.vermont.gov/statutes/section/32/154/06066

It has info like this:

“(C) For a claimant whose household income does not exceed $47,000.00, the statewide education tax rate, multiplied by the equalized value of the housesite in the taxable year, minus the lesser of:

(i) the sum of the income percentage of household income for the taxable year plus the statewide education tax rate, multiplied by the equalized value of the housesite in the taxable year in excess of $400,000.00; or

(ii) the statewide education tax rate, multiplied by the equalized value of the housesite in the taxable year reduced by $15,000.00.

(2) “Income percentage” in this section means two percent, multiplied by the education income tax spending adjustment under subdivision 5401(13)(B) of this title for the property tax year that begins in the claim year for the municipality in which the homestead residence is located.

(3) A claimant whose household income does not exceed $47,000.00 shall also be entitled to an additional credit amount from the claimant’s municipal taxes for the upcoming fiscal year that is equal to the amount by which the municipal property taxes for the municipal fiscal year that began in the taxable year upon the claimant’s housesite exceeds a percentage of the claimant’s household income for the taxable year as follows:”

…and it goes on with lots of considerations and formulas, in legal language.

I feel like the state of Vermont is "clawing back" my food stamps (SNAP) by demanding such a high property tax payment, more than one month's income!

I feel like the State of Vermont is “clawing back” my food stamps

(SNAP) by calculating my property tax too high in some mysterious

way that makes the property tax adjustment too low, resulting in me,

as a below-poverty-level senior citizen on a fixed income

paying an amount for annual property tax that exceeds one

month’s income. Poof! There goes the food stamps!

The state of Vermont Property Tax Department

has “clawed back” my food stamps. How many people in Vermont

is this happening to? I expected to pay property tax, but NOT more than

one month’s income at my poor existence below poverty level!

https://legislature.vermont.gov/statutes/section/01/005/00315

Title 1 : General Provisions

Chapter 005 : Common Law; General Rights

Subchapter 003 : ACCESS TO PUBLIC RECORDS

(Cite as: 1 V.S.A. § 315)

§ 315. Statement of policy; short title

(a) It is the policy of this subchapter to provide for free and

open examination of records consistent with

Chapter I, Article 6 of the Vermont Constitution.

Officers of government are trustees and servants

of the people and it is in the public interest

to enable any person to review and criticize their decisions

even though such examination may cause inconvenience or embarrassment.

EMAIL SENT JULY 29, 2025

I request full disclosure of your math to calculate my property tax, please!

From: Cris Ericson

To: Nancy Hammond

Nancy.Hammond@vermont.gov

Kimberly Flint

Kimberly.Flint@vermont.gov

Lisa Pinkus

Lisa.Pinkus@vermont.gov

Tue, Jul 29 at 8:08 PM

To: Vermont Property Tax Department,

Please provide me with your arithmetic

in the futherance of economic justice and

full disclosure.

I still can not believe the state of Vermont intends

to take over a month’s social security income

in annual property tax from a senior citizen

living below the national poverty level.

Please identify which sections of this law

you applied to my property tax bill

and which figures and dollar amounts

you inserted to calculate each section you

used.

The Vermont Statutes Online

The Statutes below include the actions of the

2024 session of the General Assembly.

Title 32 : Taxation and Finance

Chapter 154 : Homestead Property Tax Credit and Renter Credit

(Cite as: 32 V.S.A. § 6066)

§ 6066. Computation of property tax credit and renter credit

(a) An eligible claimant who owned the homestead on April 1

of the year in which the claim is filed shall be entitled to a credit

for the prior year’s homestead property tax liability amount determined as follows:

(C) For a claimant whose household income does not exceed $47,000.00,

the statewide education tax rate, multiplied by the equalized value of the

housesite in the taxable year, minus the lesser of:

(i) the sum of the income percentage of household income for the

taxable year plus the statewide education tax rate, multiplied by

the equalized value of the housesite in the taxable year in excess of $400,000.00; or

(ii) the statewide education tax rate, multiplied by the equalized value

of the housesite in the taxable year reduced by $15,000.00.

(2) “Income percentage” in this section means two percent, multiplied by

the education income tax spending adjustment under subdivision 5401(13)(B)

of this title for the property tax year that begins in the claim year for the

municipality in which the homestead residence is located.

(3) A claimant whose household income does not exceed $47,000.00 shall

also be entitled to an additional credit amount from the claimant’s municipal

taxes for the upcoming fiscal year that is equal to the amount by which the

municipal property taxes for the municipal fiscal year that began in the

taxable year upon the claimant’s housesite exceeds a percentage of the

claimant’s household income for the taxable year as follows:

If household income (rounded then the taxpayer is entitled to

to the nearest dollar) is: credit for the reduced property tax in excess

of this percent of that income:

$0.00 — 9,999.00 1.50

$10,000.00 — 47,000.00 3.00

(4) A claimant whose household income does not exceed $47,000.00

shall also be entitled to an additional credit amount from the claimant’s

statewide education tax for the upcoming fiscal year that is equal to the

amount by which the education property tax for the municipal fiscal year

that began in the taxable year upon the claimant’s housesite, reduced by

the credit amount determined under subdivisions (1) and (2) of this

subsection, exceeds a percentage of the claimant’s household income

for the taxable year as follows:

If household income (rounded then the taxpayer is entitled to

to the nearest dollar) is: credit for the reduced property tax in

excess of this percent of that income:

$0.00 — 9,999.00 0.5

$10,000.00 — 24,999.00 1.5

$25,000.00 — 47,000.00 2.0

(5) In no event shall the credit provided for in subdivision (3) or (4)

of this subsection exceed the amount of the reduced property tax.

The credits under subdivision (4) of this subsection shall be calculated

considering only the tax due on the first $400,000.00 in equalized housesite value.

Cris Ericson

879 Church Street

Chester, VT 05143

August 14, 2025 Response from Vermont Department of Taxes, James Whitehouse

Vermont Department of Taxes

Whitehouse, James

From: james.whitehouse@vermont.gov

To: CRIS ERICSON

Cc: Evans, Mariko

Thu, Aug 14 at 1:20 PM

Good afternoon Ms. Ericson,

It has come to my attention that you have some concerns as to how your property tax credit applied against your 2025 property tax bill for the town of Chester was calculated. You have asked for clarification and direction to applicable Vermont Statues. Please allow me to explain. The first criteria that must be established is the town’s tax rate. This calculation is a function of the town’s school district approved budget for education spending on the total number of weighted pupils allowing for a computation of spending per pupil. That per pupil spending is divided by the homestead “yield” set by the legislature on an annual basis. This sets a preliminary tax rate for the district. The district rate is divided by the result of the town’s common level of appraisal divided by the state average common level of appraisal. You can see this calculation on your 2025 town property tax bill (1.6990/91.24% =1.8621). 1.8621 is the town education tax rate per $100 of assessed housesite value (in your case 203,500/100 =2,035) the resulting 2,035 is multiplied by the determined rate of 1.8621 for a total of $3,789.37 see 32 VSA §6061(14). The municipal tax rate is set by the town and calculated per $100 of assessed value. ( in your case 2,035×1.0473) for a total of $2,131.26. therefore, your total property tax bill for 2025 is $5,920.63 ($3,789.37+$2,131.26), before applicable state credit applications.

The credits applied to you current tax bill were calculated based upon the filing of your 2025 HS-122 and HI-144 (see the below screen shot) this calculator is available on the Department’s website, as is a plethora of information regarding the calculation of the taxes and of the allowable credits https://tax.vermont.gov/property

In the EDUCATION PROPERTY TAX CREDIT CALCULATION section, line 3 is the limit of tax to be applied based upon your income level ($299).in the ADDITIONAL CREDIT CALCULATION FOR QUALIFYING HOUSEHOLDS section, line 12 is the limit of tax to be applied to the municipal portion of your property tax. In both these instances you are credited with the amounts in excess of these amounts. $3,256 – $299 = $2,957 for the education tax and $2,020- $367 = $1,653 for the municipal tax. For the education tax portion of your property tax bill there is an additional credit, based upon your income level, of $116, further reducing your education property tax amount. The total of your education property tax credit is $2,957+$116 =$3,073 and the total for your municipal property tax credit is $2,020- $367 = $1,653. These amounts are reflected in your town’s 2025 property tax bill.

You also mention your concern with the increased property taxes presented on your 2025 town property tax bill as compared to your 2024 tax bill. There are two factors at play here. Firstly, included in your 2024 education tax credit from the state was an imbedded additional 13% of the determined credit amount, for qualifying claimants. This was authorized through H.887 of the 2023/2024 legislative session.’ to help offset the drastic increase in property taxes realized that year. This additional credit amount is not available on your most recent property tax bill. Secondly, there was an increase in the town’s education tax rate from1.6001 per $100 assessed value to 1.8621 per $100 assessed value. In this instance that results in an increase in $533.17 on your tax bill. There would also have been a corresponding increase in the municipal portion of you tax bill. When we look at the overall effect of these issues your tax credit in 2025 was only $142 less than it was in 2024, and $459 more than it was in 2023.

I realize this can all sound rather confusing, and to be honest, the calculations involved can be complex. I hope this explanation helps you in understanding how your credits were calculated, as you requested.

Regards,

James Whitehouse, Director of Taxpayer Services

Vermont Department of Taxes

133 State Street, Montpelier VT 05601

phone: 802-828-6840

email: james.whitehouse@vermont.gov