Like any other homeowner in Vermont, I dread property taxes going up. With pain, I look online at real estate in other states southward, and estimate how fast higher and more frequent humidity and heat, and an attack of strange insect bites could kill me. Don’t forget the air conditioning bill for many more months than you would use one in Vermont. I don’t even have an air conditioner,

I have a cool basement.

Why should Vermonters be taxed just to have their tax dollars turned over to the University of Vermont which pays their President more money than most Vermonters earn in a ten year period, AND UVM is not required to be AUDITED by our State Auditor even though they receive millions in our hard earned tax dollars?

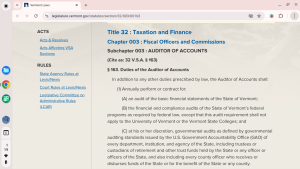

Vermont Statutes

Title 32 : Taxation and Finance

Chapter 003 : Fiscal Officers and Commissions

Subchapter 003 : AUDITOR OF ACCOUNTS

(Cite as: 32 V.S.A. § 163)

§ 163. Duties of the Auditor of Accounts

In addition to any other duties prescribed by law, the Auditor of Accounts shall:

(1) Annually perform or contract for:

(A) an audit of the basic financial statements of the State of Vermont;

(B) the financial and compliance audits of the State of Vermont’s federal programs as required by federal law, except that this audit requirement shall not apply to the University of Vermont or the Vermont State Colleges; and

DID YOU SEE THAT in (B) ABOVE? “SHALL NOT APPLY TO THE UNIVERSITY OF VERMONT OR THE VERMONT STATE COLLEGES”. THEY ARE NOT AUDITED BY THE STATE AUDITOR? HOW CONVENIENT!

(C) at his or her discretion, governmental audits as defined by governmental auditing standards issued by the U.S. Government Accountability Office (GAO) of every department, institution, and agency of the State, including trustees or custodians of retirement and other trust funds held by the State or any officer or officers of the State, and also including every county officer who receives or disburses funds of the State or for the benefit of the State or any county.

Maybe I’m wrong, but this doesn’t pass the PROPERTY TAX SMELL TEST in my opinion.

Education FUN or education funding?

FY 2025 Detailed Operating Budget

University of Vermont

https://www.uvm.edu › Buddoc_FY-2025 The University of Vermont’s operating expense budget is expected to total $941M for FY 2025.

(2022) The University of Vermont will pay incoming president Suresh Garimella $630,000 a year.

Maybe you think this is fine and dandy, for a University President to receive a salary of over 10 times the amount the average Vermonter works hard for.

It makes zero sense to me, and that’s just my opinion.

Every time someone says that our property taxes pay for education, I wonder how much money University of Vermont is sitting on in foreign bank accounts and endowments.

We usually think of property taxes paying for K-12 education, but we do pay taxes TO UVM that accumulate into a fistfull bigger than Mt. Mansfield.

I just don’t like this sneaky little law saying the Vermont State Auditor shall not audit UVM. The State Auditor sits on the UVM board, but I imagine they are just sitting around drinking fine wine and eating gourmet duck for dinner.

BEFORE OUR PROPERTY TAZES ARE RAISED, we need to know what our money is being used for!

Google: University of Vermont (UVM) receives substantial taxpayer funding, including an annual state appropriation of over $42 million for operations and tuition support.

See above “STATE APPROPRIATION”. Is that our hard earned tax dollars, and if so, then we should be able to Audit the use of our state tax dollars! Just my opinion.

You can read more of my opinions on taxes at http://CRISERICSON.com